tax saving strategies for high income earners canada

Here are five tax saving tips that are easy to apply. One way to reduce your tax burden is to change the character of your income.

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

The RRSP can be a great way for higher-income earners to get a hefty tax return but can also be a way for Canadians in any tax bracket to pay less money to the government.

. Taking advantage of all of your allowable tax deductions and credits. Tax deductions are expenses that can be deducted from your taxable income and therefore your tax liability. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income.

Change the Character of Your Income. The math is simple. RRSP contributions are tax deductible and any income and gains earned inside a RRSP are not taxable.

Tax saving tips for high income earners. All the investment income in the TFSA grows tax-free and future withdrawals are not taxable. Your RRSP limit for the current year 2018 is shown on your 2017 Notice of Assessment.

Two a spousal loan strategy which enables your lower income spouse to earn investment income at their lower tax rate. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds a set amount. Tax-advantaged savings plans are a smart way to save for retirement and lower your tax bill.

Income splitting opportunities permitted under current legislation include but arent. 50 Best Ways to Reduce Taxes for High Income Earners. RRSP limit for the year.

Tax-Free Savings Account TFSA In addition to investing in a TFSA of your own consider making a gift to your adult family members or spouse to enable them to contribute to a TFSA. High income earners have a very solid option with RRSPs in reducing taxes. The benefits of the RRSPs over the TFSA arise mainly based on the tax bracket of an individual in retirement and whether it is higher or lower compared to the time of initial.

A Retirement Savings Plan RSP will allow you to shelter your savings from tax. Do you earn a lot of money. Registered Retirement Savings Plans RRSPs Registered Education Savings Plans RESPs and Tax-free Savings Accounts TFSAs.

For income levels between 273000 and 300000 it will be between 34 and 19 and for income levels above 300000 the saving will be 19. To prevent passive investment income unrelated to the active nature of the business from being unduly spared from taxation the CRA has put a policy in place that will see the 500000 SBD threshold rolled back by 5 for every 1 of passive income earned inside the corporation in excess of 50000 per annum thereby exposing more business income to higher. While a Tax-Free Savings Account TFSA lets you withdraw money without penalty.

Contributions to an RRSP lower your taxable income. Tax Saving Strategies for High-Income Earners. The interest on anything else you assume to debt to buy is not.

Check your RSP deduction limit on your most recent Notice of Assessment from the CRA. Here are a couple of tax planning strategies that will be highly effective for you. One of best ways for high earners to save on taxes is to establish and fund retirement accounts.

You can deduct the amount you. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. These changes are significant because they make it possible for high-income earners to make additional contributions to a retirement plan during the tax year.

Fortunately there are many ways high earners can reduce the taxes on their income. One a family trust which enables you to provide funds for your children or grandchildrens needs while reducing taxes. The contribution you will make will come straight out of your.

Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts. The more money you make the more taxes you pay. 2 From a tax perspective youre better off using cash or savings for these discretionary purchases and then borrowing to invest.

The more money you make the more taxes you pay. Sheltering investment income through RRSPS is one way that the Canadian government has availed. Further there will generally be no income.

One of best ways for high earners to save on. Make a contribution each year to your RRSP Registered Retirement Savings Plan to the maximum amount allowed ie. But with big money can come big taxes.

Typically the RRSP is more beneficial to higher-income earners. As of the 2014 tax year couples who have at least one child under 18 can effectively transfer up to 50000 of taxable income to their lower-income partner and claim a non-refundable tax credit. Heres some other ways to reduce tax.

50 best ways to reduce taxes for high income earners. For higher-income earners income splitting redirecting income within a family unit can be one of the most powerful tools for families to reduce their tax burden and keep after-tax dollars in their hands versus more of their income going to the Canada Revenue Agency. There are also a lot of tax credits available which reduce your tax liability dollar for dollar.

Each plan defers or mitigates tax obligations in different ways. For the nations highest-income earners those making more than 220000 annually the amount going to the tax man is.

How Do Taxes Affect Income Inequality Tax Policy Center

How To Calculate Foreigner S Income Tax In China China Admissions

The Canadian Income Taxation Statistical Analysis And Parametric Estimates Kurnaz Canadian Journal Of Economics Revue Canadienne D 233 Conomique Wiley Online Library

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

How The Super Rich Avoid Paying Taxes

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

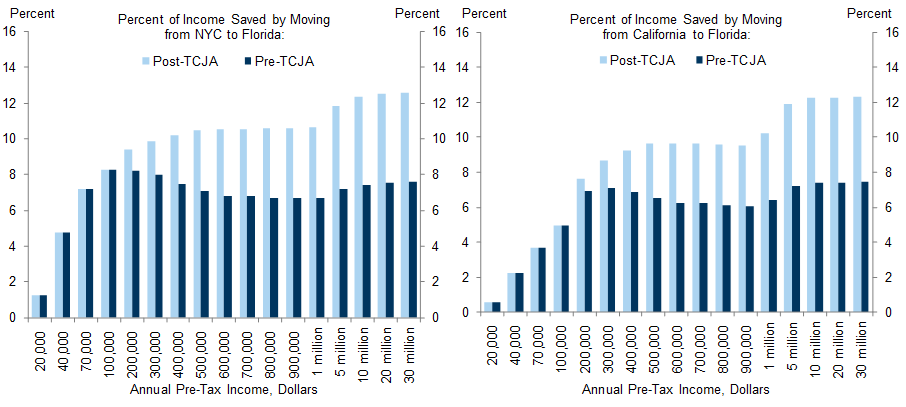

No Taxation Without Emigration Briggs

High Income Earners Need Specialized Advice Investment Executive

What Are Real Assets And How To Diversify Your Wealth By Investing In Them Investing Diversify Business Management

Annual S P Sector Performance Novel Investor Stock Market Global Indices Charts And Graphs

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How Do Taxes Affect Income Inequality Tax Policy Center